Your payslip is a vital document that gives you insight into your earnings, deductions, and take-home pay. Checking it regularly ensures that you’re paid accurately and helps you understand how your compensation is structured. Below, we break down how to review payslips across the UK, US, and France, along with common elements found in payslips worldwide.

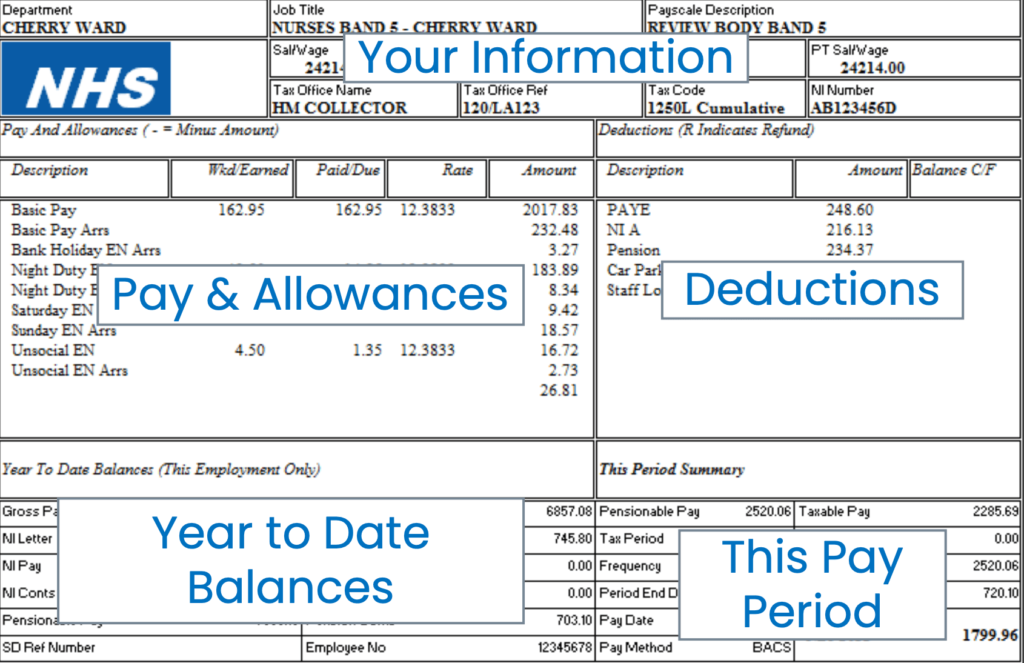

UK Net Pay Payslip

Pay & Allowances

- Basic Pay: Your standard salary or hourly rate for contracted hours. This forms the core of your earnings.

- Basic Pay Arrears: Adjustments to pay for prior periods, ensuring past discrepancies are corrected.

- Bank Holiday Enhancements Arrears: Payments for bank holiday shifts from previous periods, often with a premium rate.

- Night Duty Enhancements: Additional pay for working night shifts, compensating for unsocial hours.

- Saturday Enhancements: Higher pay for working on Saturdays, reflecting weekend working conditions.

- Sunday Enhancements: Premium pay for Sunday shifts, recognizing the impact of weekend work.

- Unsocial Enhancements: Payments for shifts outside regular hours, such as late evenings or early mornings.

- Unsocial Enhancements Arrears: Adjustments to unsocial hour payments from earlier periods.

Deductions

- PAYE (Pay As You Earn): Income tax is deducted directly from your salary, ensuring compliance with UK tax laws.

- NI (National Insurance) Contributions: Payments toward your state benefits, such as pensions and healthcare.

- Pension Contributions: Amounts contributed to your workplace pension scheme, securing your financial future.

- Car Parking Deduction: Charges for staff parking, deducted directly from your pay if applicable.

- Staff Lottery: Voluntary contributions to workplace lotteries, often for charity or prize draws.

Year to Date Balances

- Gross Pay: The total pay you’ve earned before deductions, reflecting your earnings to date.

- NI Pay: The amount of your salary subject to National Insurance contributions over the year.

- Pensionable Pay: The portion of your earnings considered for pension calculations.

- Employee Number: A unique identifier used to track your employment and payroll records.

This Pay Period

- Pay Date: The date your salary is credited to your account, ensuring timely payment tracking.

- Pay Frequency: Indicates whether you are paid weekly, monthly, or on another schedule, helping plan your finances.

- Tax Period: Shows the tax period number (e.g., month or week) to align with HMRC's tax calendar.

- Net Pay: The amount you take home after all deductions, reflecting your actual earnings for this period.

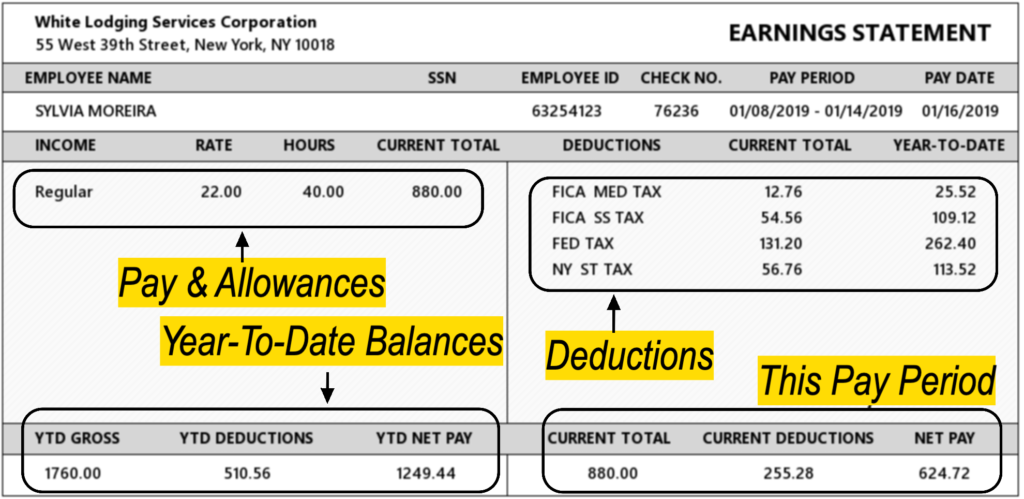

USA Net Pay Payslip

Pay & Allowances

- Gross Pay: The total earnings for the pay period before any deductions, reflecting your agreed salary or hourly wage.

- Overtime Pay: Additional compensation for hours worked beyond the standard 40-hour workweek, usually at 1.5 times the regular rate.

- Holiday Pay: Pay for working on designated holidays, often at an enhanced rate.

- Bonus: Additional earnings outside of regular pay, typically for performance or special events.

- Commissions: Pay tied to sales or performance metrics, common in sales-related roles.

- Shift Differential: Extra pay for working less desirable hours, such as night shifts.

Deductions

- Federal Tax Withholding: Income tax withheld by your employer, based on your W-4 form and federal tax brackets.

- State Tax Withholding: State income tax deductions, varying by state laws and your declared exemptions.

- Social Security (FICA): Contributions toward your future retirement benefits, mandated by federal law.

- Medicare (FICA): Deductions funding your health coverage upon retirement, a federal requirement.

- Health Insurance: Premiums for employer-sponsored health coverage, deducted pre-tax or post-tax depending on the plan.

- Retirement Contributions: Contributions to employer-sponsored plans like a 401(k), building your retirement savings.

- Other Deductions: These may include union dues, life insurance, or charitable contributions.

Year-to-Date Balances

- Gross Pay to Date: Total gross earnings for the year, reflecting your overall income.

- Federal Tax Withholding to Date: The cumulative amount of federal income tax deducted since 1st of January

- State Tax Withholding to Date: The total state income tax deducted over the year.

- Social Security Contributions to Date: Your year-to-date contributions toward Social Security.

- Medicare Contributions to Date: The cumulative Medicare deductions made so far.

This Pay Period

- Pay Date: The date your earnings are disbursed to your bank account or issued as a check.

- Pay Frequency: Indicates whether you are paid weekly, biweekly, semi-monthly, or monthly, helping you align your financial planning.

- Pay Period: The range of dates for which this paycheck applies.

- Net Pay: The actual amount deposited into your account after all deductions.

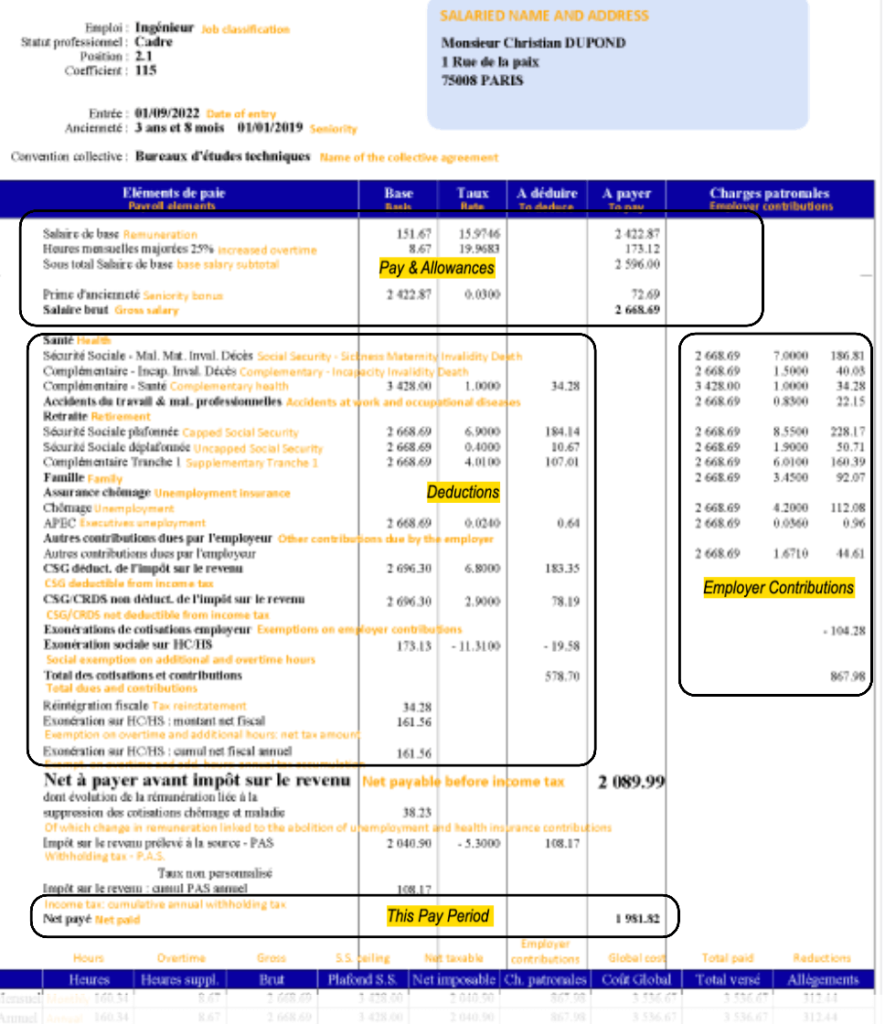

France Net Pay Payslip

Pay & Allowances

- Salaire Brut (Gross Salary): The total salary for the pay period before deductions, reflecting your contracted pay or hours worked.

- Primes (Bonuses): Additional earnings, such as performance bonuses, loyalty bonuses, or attendance bonuses.

- Indemnités (Allowances): Payments for specific conditions, like transportation, meals, or childcare.

- Heures Supplémentaires (Overtime Hours): Extra pay for hours worked beyond the legal 35-hour workweek, often at an enhanced rate.

- Indemnités de Congés Payés (Paid Leave Allowances): Compensation for paid vacation days.

Deductions

- Cotisations Sociales (Social Contributions): Mandatory deductions for healthcare, unemployment insurance, and pensions. These are essential for accessing state benefits.

- Impôt à la Source (Income Tax Withholding): The income tax deducted directly from your salary, based on your tax declaration and withholding rate.

- Mutuelle Santé (Health Insurance): Contributions to employer-sponsored health insurance plans.

- Prévoyance (Provident Fund): Contributions to supplementary health or pension schemes, offering additional coverage.

- Autres Déductions (Other Deductions): May include cafeteria plans, charity donations, or union dues.

Year-to-Date Balances

- Salaire Brut Cumulé (Cumulative Gross Pay): The total gross salary earned since January 1.

- Cotisations Sociales Cumulées (Cumulative Social Contributions): Total deductions for social security, unemployment, and pensions over the year.

- Impôt Cumulé (Cumulative Income Tax): The total income tax withheld from your salary so far.

- Net Imposable (Taxable Net Income): The portion of your earnings used to calculate your annual income tax.

This Pay Period

- Date de Paiement (Pay Date): The date your salary is transferred to your bank account.

- Période de Paie (Pay Period): The specific range of dates covered by this payslip.

- Salaire Net à Payer (Net Pay): The amount you’ll receive after all deductions.

- Salaire Net Avant Impôt (Net Pay Before Income Tax): Your take-home pay before the income tax withholding is applied.

Italy Net Pay Payslip

Header Information

- Ragione Sociale: Business name of your employer.

- Codice Azienda: Unique company code.

- Indirizzo: The employer's address.

- Codice Fiscale: Tax number of the employer.

- Centro di Costo: Department or cost center where you work.

- Codice Dipendente: Unique employee code assigned to you.

- Data di Nascita: Your date of birth.

- Data Assunzione: Start date of your employment.

- Data Cessazione: End date of your employment (if applicable).

Work and Hours Information

- Giorni: Total days worked during the pay period.

- Ore Ordinarie: Ordinary hours worked.

- Ore Straordinarie: Extra hours worked (overtime).

- Giorni Detrazioni: Days deducted (e.g., for unpaid leave).

Pay Items

- Retribuzione Ordinaria MP: Base pay for regular hours.

- Competenza/Provvigioni: Commissions or bonuses earned.

- RSU Shares: Restricted stock units used to cover taxes.

- RSU Stock Options DL: Value of stock options

Deductions

- Trattenute: Total deductions, including taxes and contributions.

- Contributo INPS: Pension contributions paid to INPS (National Institute of Social Security).

- IRPEF: Personal income tax deduction.

- Contributo INAIL: National Insurance for workplace accidents.

Allowances and Benefits

- Assegno Nucleo Familiare: Family allowance benefit.

- Anticipo Festività: Advance pay for holidays.

- Assicurazione Sanitaria: Personal accident or health insurance.

Final Balances

- Saldo: Final balance of your pay.

- Netto del Mese: Net pay (take-home amount for the month).

- Banca: Bank where your salary is deposited, including branch and IBAN details.

Additional Information

- T.F.R.: Severance pay accrued over time.

- Quota IRPEF: Paid income tax summary for the year.

- Ratei: Accrued holiday and leave balances.

Key Takeaways

- Review your gross pay (Retribuzione Totale) to verify earnings.

- Check deductions like IRPEF and INPS to ensure compliance.

- Confirm your Netto del Mese matches your actual bank deposit.

- Understand your T.F.R. and other accrued benefits for long-term planning.

By carefully reviewing each section of your payslip, you can ensure accuracy, track deductions, and understand your financial entitlements.

Personal Tip: Always cross-check your payslip with your employment contract to ensure consistency.

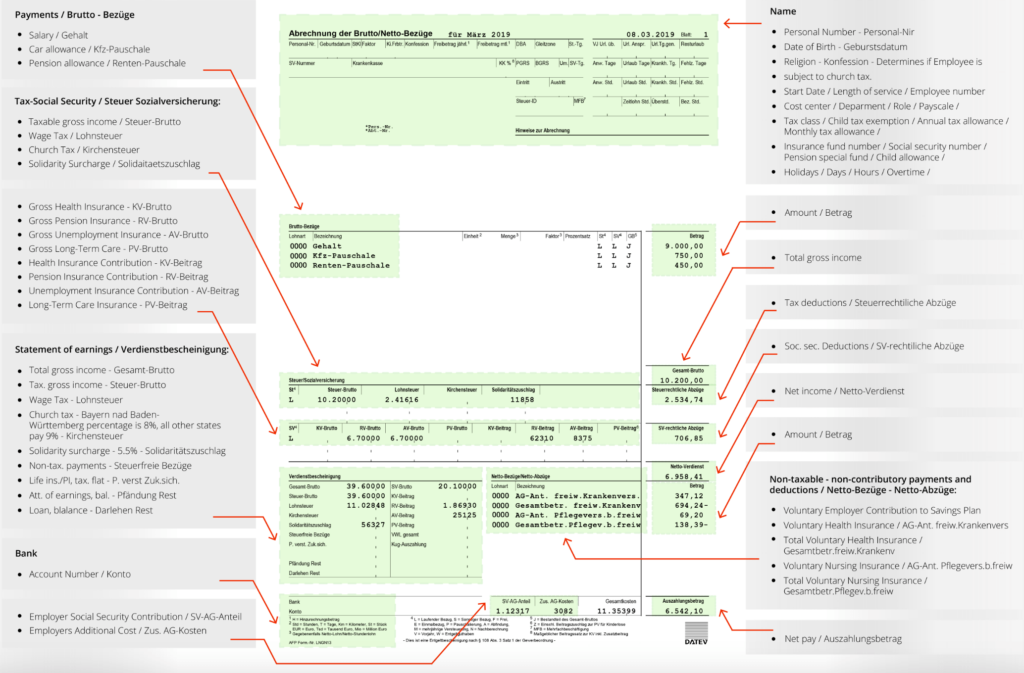

Germany Net Pay Payslip

Personal and Employer Information

- Personal Number (Personal-Nr): Your unique employee ID.

- Date of Birth (Geburtsdatum): Your date of birth.

- Religion (Konfession): Indicates whether you are subject to church tax (Kirchensteuer).

- Tax Class (Steuerklasse): Determines your income tax rate based on your marital status.

- Start Date/Length of Service: Tracks your employment duration.

- Social Security Number (Sozialversicherungsnummer): Used for pension and social security contributions.

- Payscale (Entgeltgruppe): Your salary grade or level.

Earnings (Brutto-Bezüge)

- Gehalt (Salary): Total gross salary before deductions.

- Kfz-Pauschale (Car Allowance): Taxable car allowance for work-related travel.

- Renten-Pauschale (Pension Allowance): Taxable allowance towards your pension.

Tip: This section summarises all earnings before taxes and contributions are deducted.

Tax-Social Security Deductions (Steuer/Sozialversicherung)

- Taxable Gross Income (Steuer-Brutto): Your total income subject to tax.

- Wage Tax (Lohnsteuer): Income tax deducted based on your tax class.

- Church Tax (Kirchensteuer): Additional tax if you are registered with a religious group (e.g., 8–9%).

- Solidarity Surcharge (Solidaritätszuschlag): A surcharge to support economic development (typically 5.5% of your wage tax).

Social Contributions (SV-rechtliche Abzüge):

- KV-Brutto: Gross health insurance contribution.

- RV-Brutto: Pension insurance contribution.

- AV-Brutto: Unemployment insurance contribution.

- PV-Brutto: Long-term care insurance contribution.

Tip: These deductions fund Germany’s social security system, including healthcare, pensions, unemployment benefits, and long-term care.

Statement of Earnings (Verdienstbescheinigung)

- Gesamt-Brutto (Total Gross Income): The total earnings before deductions.

- Steuer-Brutto (Tax Gross Income): The portion of your earnings subject to tax.

- Kirchensteuer (Church Tax): Calculated as a percentage of your taxable income.

- Solidaritätszuschlag: Surcharge applied to your wage tax.

- Life Insurance or Private Contributions (Versicherungsbeiträge): Deductions for optional private insurance.

Loan or Attachments (Pfändung): Indicates any outstanding loans or garnished wages.

Net Pay (Netto-Verdienst)

- Netto-Verdienst: The final take-home pay after all taxes and deductions.

- Auszahlungsbetrag: The exact amount deposited into your bank account.

Bank Information (Konto)

Bank Account (Konto): Specifies the account and IBAN where your salary is deposited.

Employer Contributions (Arbeitgeberanteil)

- SV-AG-Anteil: Employer’s share of social security contributions, including health, pension, and unemployment insurance.

- Zus. AG-Kosten: Additional employer costs for benefits.

Tip: While these contributions do not affect your take-home pay, they demonstrate your employer’s commitment to funding your benefits.

Key Takeaways

- Always verify your Netto-Verdienst against the bank deposit.

- Cross-check deductions for accuracy, especially Lohnsteuer, Solidaritätszuschlag, and Kirchensteuer.

- Understand your Steuerklasse as it impacts the taxes deducted from your salary.

- Keep track of your social security contributions (KV, RV, AV, PV) for retirement and benefits eligibility.

Pro Tip: Save your payslips for tax declarations or any employment-related queries.