Income Tax (Einkommensteuer)

What is Income Tax?

- In Germany, income tax is levied at the national level and is calculated using progressive rates. The more you earn, the higher the percentage applied to your income.

Tax Rates (2024-25):

- Up to €11,604: 0% (tax-free allowance)

- €11,605 to €66,760: Progressive rates starting at 14% and increasing up to 42%

- €66,761 to €277,825: 42%

- Above €277,825: 45%

Solidarity Surcharge (Solidaritätszuschlag)

What is the Solidarity Surcharge?

- This surcharge was introduced to support the costs of reunifying East and West Germany. As of 2024-25, it is levied only on higher incomes.

Rate:

- No surcharge: Income tax below €16,956.

- 5.5% of income tax: For income tax above €16,956.

Calculation for €54,444:

- Since the income tax (€12,561.55) is below the threshold, the solidarity surcharge is €0.

Church Tax (Kirchensteuer)

What is Church Tax?

If you are a member of a recognised religious organisation, you pay a church tax. This tax is typically:

- 8% of income tax in Bavaria and Baden-Württemberg.

- 9% of income tax in other states.

Example Calculation (9% rate):

€12,561.55×9%=€1,130.54

Exemptions:

- You are not required to pay this tax if you formally leave the church.

Social Security Contributions

What are Social Security Contributions? Social security is mandatory in Germany and includes:

- Pension Insurance (Rentenversicherung): 18.6% (9.3% employee share).

- Health Insurance (Krankenversicherung): 14.6% + 1.3% additional rate (split equally, 8.15% employee share).

- Unemployment Insurance (Arbeitslosenversicherung): 2.4% (1.2% employee share).

- Long-Term Care Insurance (Pflegeversicherung): 3.4% (1.7% employee share, +0.6% if childless).

Net Pay Germany: What Do You Need to Know About Recent Changes?

Germany is set to implement several significant changes affecting take-home pay in 2024-25. Here’s what you need to know:

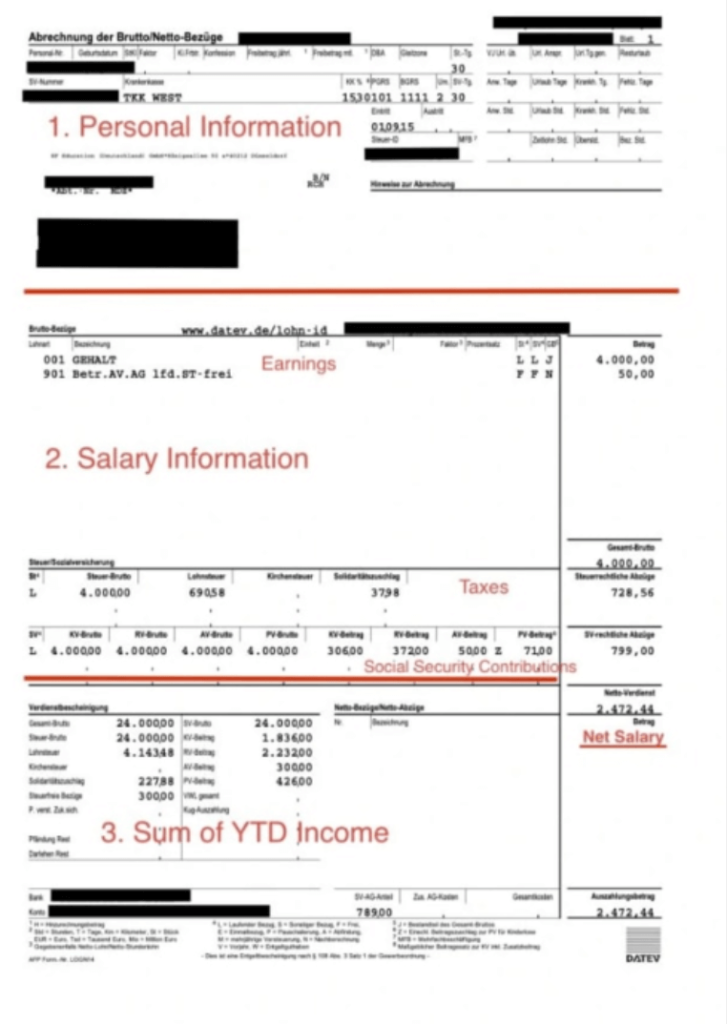

Understanding Your Germany Payslip: A Detailed Breakdown

Your German payslip (Gehaltsabrechnung) provides a detailed record of your earnings, deductions, and take-home salary. Understanding its components is essential for tracking your finances, ensuring accuracy, and planning for taxes and social contributions. Here’s a breakdown of the key elements of a German payslip:

Employee and Employer Information

This section includes:

- Employee Details: Your name, tax ID number (Steuer-ID), social security number (Sozialversicherungsnummer), and position.

- Employer Details: The company’s name, address, tax number (Steuernummer), and registration code for social security contributions.

Why it matters: These details ensure that the payslip is correctly attributed to you and that your employer complies with tax and social contribution regulations.

Pay Period

This section indicates the period for which you are being paid, typically monthly. It also includes:

- The specific work dates covered.

- The date of payment, when the net pay is transferred to your account.

Gross Salary (Bruttogehalt)

Your gross salary is the total amount earned before any deductions. It includes:

- Base Salary: Your contracted monthly or hourly wage.

- Bonuses or Allowances: Such as holiday pay (Urlaubsgeld), Christmas bonuses (Weihnachtsgeld), or overtime pay (Überstunden).

Key Tip: Check this section for any additional earnings and ensure they match your employment contract.

Social Security Contributions (Sozialabgaben)

Social contributions are mandatory in Germany and fund public services like healthcare and pensions. Both employees and employers contribute to these schemes. Deductions include:

- Health Insurance (Krankenversicherung): Typically 7.3% of gross salary, with an additional surcharge (around 1.7%).

- Pension Insurance (Rentenversicherung): 9.3% of gross salary.

- Unemployment Insurance (Arbeitslosenversicherung): 1.3% of gross salary.

- Long-Term Care Insurance (Pflegeversicherung): 1.525%, with an additional 0.35% for childless employees.

Why it matters: These deductions reduce your net pay but fund extensive public benefits, including healthcare, pensions, and unemployment support.

Income Tax (Lohnsteuer)

Income tax is calculated based on your taxable income and tax class (Steuerklasse). Germany uses a progressive tax system, with rates ranging from 0% to 45%. Key components include:

- Solidarity Surcharge (Solidaritätszuschlag): Applied at 5.5% of your income tax, though many workers are now exempt.

- Church Tax (Kirchensteuer): Optional, at 8-9% of your income tax, depending on your state.

Key Tip: Your tax class significantly affects your income tax rate. For example:

- Class I: Single individuals.

- Class III: Married couples with one high earner.

Tax-Free Allowances (Freibeträge)

Tax-free allowances reduce your taxable income and are shown on your payslip. Key allowances include:

- Basic Tax-Free Allowance (Grundfreibetrag): €11,784 in 2024.

- Child Allowance (Kinderfreibetrag): €6,612 per child.

Net Salary (Nettogehalt)

This is your take-home pay after all deductions for taxes and social contributions. It’s the final amount deposited into your bank account.

Leave Balances

Your payslip may include:

- Vacation Days (Urlaubstage): The number of days you’ve accrued, used, and have remaining.

- Overtime Balances (Überstunden): Hours worked beyond your contracted schedule.

Why It’s Important to Understand Payslip

- Ensure Accuracy: Verify deductions and earnings to avoid errors.

- Plan Finances: Knowing your net pay helps with budgeting and tax planning.

- Track Benefits: Ensure your contributions match the benefits you expect, like pensions and healthcare.

Additional Information

Other sections may include:

- Bonuses and Benefits: Profit-sharing schemes, travel reimbursements, or meal vouchers.

- Mini-Job Exemptions: For part-time work earning less than €538 per month (2024 threshold).

Comparing Net Salary in France and Germany: Key Factors to Consider

When comparing net salaries between France and Germany, several key factors influence take-home pay, including average gross salaries, taxation, social security contributions, and the cost of living.

Average Net Salaries

As of December 2024, the average monthly net salary (after tax) is approximately €2,842 in Germany and €2,360 in France, indicating that German employees, on average, take home about 20% more than their French counterparts.

Taxation

- Germany: Employs a progressive tax system with rates ranging from 0% to 45%. The basic tax-free allowance (Grundfreibetrag) for 2024 is €11,784 for single individuals.

- France: Also utilizes a progressive tax system with rates from 0% to 45%. The 2024 tax brackets are:

- 0%: Up to €10,777

- 11%: €10,778 – €27,478

- 30%: €27,479 – €78,570

- 41%: €78,571 – €168,994

- 45%: Above €168,994

Social Security Contributions

- Germany: Employees contribute to health insurance (7.3% plus an additional surcharge), pension insurance (9.3%), unemployment insurance (1.3%), and long-term care insurance (1.525%, with an additional 0.35% for childless employees).

- France: Employees contribute to various social security schemes, including health, pension, unemployment, and family allowances, totalling approximately 22% of gross salary.

Cost of Living

The cost of living is a crucial factor when comparing net salaries:

- France: The average cost of living is around $1,616 per month.

- Germany: Slightly higher at approximately $1,671 per month.

While German net salaries are higher, the marginally increased cost of living may offset some of this advantage.

Conclusion

Although Germany offers higher average net salaries compared to France, factors such as taxation, social security contributions, and living expenses play significant roles in determining actual take-home pay and purchasing power. Individuals considering employment in either country should evaluate these elements concerning personal circumstances.

Frequently Asked Questions:

What is Net Pay in Germany and How is it Different from Gross Pay?

Net pay is the amount of money an employee takes home after all deductions, such as income tax, health insurance, pension contributions, and other social security contributions, are subtracted from their gross salary. Understanding the difference between gross and net pay is crucial for managing finances in Germany.

How Do Tax Classes (Steuerklassen) Affect Net Pay in Germany?

Germany’s tax system uses six tax classes to determine the amount of income tax deducted from your salary. Choosing the correct tax class can significantly impact your net pay and overall tax burden. For example, married couples may benefit from selecting a Class III/V combination instead of Class IV/IV.

What are the Latest Income Tax Rates and Brackets in Germany for 2024?

The 2024 tax brackets in Germany are progressive, starting with a tax-free allowance of €11,784. Rates range from 14% for lower incomes to 45% for incomes above €277,825. Understanding these brackets helps employees and freelancers estimate their net salary.

What Deductions Reduce Net Pay in Germany?

Key deductions from gross salary include income tax, the Solidarity Surcharge, Church Tax (if applicable), and mandatory social security contributions. These contributions fund essential services like health insurance, pensions, and unemployment benefits, ensuring financial security in various life stages.

How Can I Calculate My Net Pay in Germany for 2024?

Use an online net pay calculator to get a detailed salary breakdown. Tools like the German Gross-to-Net Calculator factor in all deductions, including tax class, income tax, social security contributions, and additional surcharges like Church Tax, to accurately estimate your take-home pay.

Helpful resources:

Personalised net pay calculation in France, including adjustments for your circumstances, use the France Salary Simulator.

For a global salary calculator that compares net pay across multiple countries, explore the tool available at the link below.