Net Pay France: Key Changes for 2025

Updated Income Tax Brackets

France’s income tax brackets for 2025 have been adjusted to reflect inflation. This prevents individuals from paying higher taxes solely due to wage increases and ensures purchasing power is maintained.

The updated brackets are as follows:

| Tax Rate | 2024 Bracket (EUR) | 2025 Bracket (EUR) |

|---|---|---|

| 0% | Up to €10,777 | Up to €11,520 |

| 11% | €10,778 to €27,478 | €11,521 to €29,373 |

| 30% | €27,479 to €78,570 | €29,374 to €83,988 |

| 41% | €78,571 to €168,994 | €83,989 to €180,648 |

| 45% | Over €168,994 | Over €180,648 |

Key Impact:

- Employees earning up to €11,520 annually will continue to pay no income tax.

- Higher thresholds for each tax band mean most employees will retain more of their gross income.

Changes to Social Security Contributions

Social security contributions in 2025 will see significant adjustments to improve equity between salaried and self-employed workers:

For Salaried Employees:

No major changes to contribution rates for employees. Social contributions remain as follows:

- Health Insurance: 9.2% of gross salary.

- Pension Contributions: 7% (up to a certain ceiling) and 0.35% beyond the ceiling.

- Unemployment Insurance: 2.4% of gross salary.

For Self-Employed Workers:

- Unified Contribution Base: The social contribution base for self-employed individuals will now match the calculation method used for the Generalised Social Contribution (CSG). This simplifies the system and ensures parity with salaried employees.

Pension Contribution Rate Increase:

- 2024: 23.1%

- 2025: 24.6%

- 2026: 26.1%

Key Impact:

- Self-employed workers will pay higher pension contributions, strengthening their retirement protections.

- Employees will see no additional burden, maintaining stable net pay.

Restructuring Employer Social Contribution Exemptions

Employer exemptions for social contributions are being restructured to address disparities and control costs.

Key Changes:

- High Earners: For employees earning over three times the minimum wage (SMIC, approximately €5,680 per month in 2025), employer exemptions on social contributions will be reduced.

- Phased Implementation: Full restructuring will take effect by 2026, but the groundwork begins in 2025.

Implications for Employees:

- High-earning employees may see less generous employer-provided benefits as a result of reduced exemptions.

- Employers may adjust compensation packages to accommodate these changes.

Examples of Impact

Scenario 1: A Middle-Income Employee

- Gross Salary: €40,000 per year.

- 2024 Net Pay: Approximately €30,000 after taxes and social contributions.

- 2025 Net Pay: Expected to increase slightly due to higher income tax thresholds, saving around €200 annually.

Scenario 2: A High-Income Employee

- Gross Salary: €100,000 per year.

- 2024 Tax Rate: 41% applied to earnings over €78,571.

- 2025 Tax Rate: 41% now applies only to earnings over €83,989, saving approximately €2,000 in taxes annually.

Scenario 3: A Self-Employed Worker

- 2024 Pension Contribution: €6,930 (23.1% of €30,000 taxable income).

- 2025 Pension Contribution: €7,380 (24.6% of €30,000 taxable income).

Summary of 2025 Changes

| Category | 2024 Rules | 2025 Updates | Impact |

| Income Tax Brackets | 0% up to €10,777 | 0% up to €11,520 | Lower tax liabilities for most employees. |

| Pension Contributions | Self-employed: 23.1% | Self-employed: 24.6% | Higher costs for self-employed workers. |

| Employer Exemptions | Generous for high earners | Reduced for earnings over €5,680/month | Possible impact on employer-provided benefits. |

Gross Salary

This is your total salary before any deductions or benefits are applied.

- Example: €50,000 annually.

Social Security Contributions (SSC)

A percentage of your gross salary is deducted for mandatory contributions, which cover health insurance, retirement pensions, unemployment insurance, and other benefits.

- Rates based on contract type:

- CDD (fixed-term): 24%

- CDI (permanent): 22%

- Other contracts: 20%

- Example for CDI:

Social Security Contribution = €50,000 × 22% = €11,000.

Taxable Income

Taxable income is calculated by subtracting the social security contributions from your gross salary.

- Example:

Taxable Income = €50,000 - €11,000 = €39,000.

Income Tax

Income tax in France is calculated using progressive tax brackets, where portions of your income are taxed at increasing rates.

2024 Tax Brackets:

- Up to €11,294: 0%

- €11,295 to €28,797: 11%

- €28,798 to €82,341: 30%

- €82,342 to €177,106: 41%

- Above €177,106: 45%

- Example for €39,000 taxable income:

- First €11,294: 0% → €0.

- Next €17,502 (€28,797 - €11,295): 11% → €1,925.22.

- Remaining €10,202 (€39,000 - €28,798): 30% → €3,060.60.

Total Income Tax: €0 + €1,925.22 + €3,060.60 = €4,985.82.

Additional Deductions

Some additional deductions may apply, such as:

- Supplementary pensions (e.g., company retirement plans).

- Health insurance premiums (if employer provides supplemental coverage).

Example: €1,500 in deductions.

Employer Benefits/Allowances

Employer-provided benefits such as meal vouchers, transportation reimbursements, or housing allowances can increase your effective take-home pay.

Example:

- Meal Vouchers: €1,200 annually.

- Transportation Reimbursement: €800 annually.

- Total Benefits: €2,000.

Net Pay Calculation

Net pay is the final amount you take home after all deductions and benefits are applied.

Formula:

Net Pay = Gross Salary - Social Security Contributions - Income Tax + Benefits - Additional Deductions.

Example:

Net Pay = €50,000 - €11,000 - €4,985.82 + €2,000 - €1,500 = €34,514.18.

What Do You Need to Know About Recent France Net vs Gross Pay Changes for 2024?

France has introduced significant changes in 2024 that impact how your salary is calculated. These updates include adjustments to income tax brackets, social contributions, and tax credits, all of which can influence your take-home salary. Here’s a breakdown of the key changes you need to know:

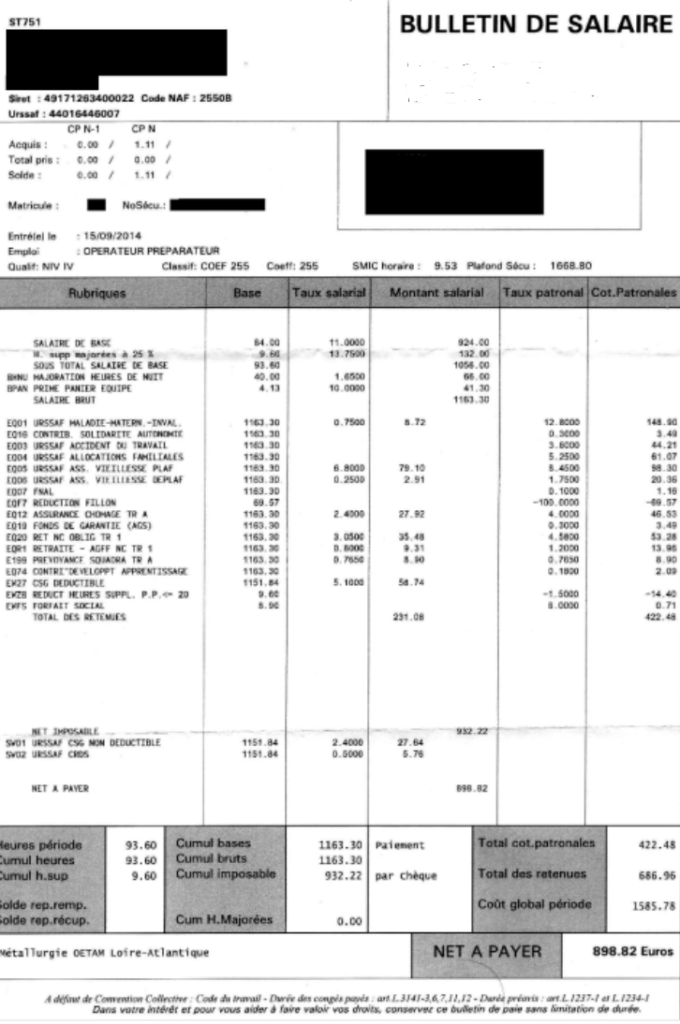

Understanding Your France Payslip: A Detailed Breakdown

A payslip in France can seem complicated at first glance, but understanding it is essential to managing your finances and ensuring accuracy. French payslips are highly detailed, outlining gross pay, various deductions, and take-home pay. Here’s a breakdown of the key sections and what they mean:

Employee Information

The payslip typically starts with:

- Employee Details: Your name, position, employee ID, and contract type (e.g., CDI or CDD).

- Employer Details: The company’s name, address, SIRET number (business ID), and APE code (industry classification).

Why it matters: This section confirms the legitimacy of your employer and ensures the payslip is linked to the correct employment contract.

Pay Period

This section specifies the period for which you are being paid, usually monthly. It includes:

- Work Dates: The dates the payslip covers.

- Payment Date: When your salary will be deposited.

Gross Salary

This is your total earnings before any deductions. It includes:

- Base Salary: Your contracted pay for the hours worked.

- Bonuses and Allowances: Such as performance bonuses, overtime pay, transport allowances, or meal vouchers (tickets-restaurant).

- Other Earnings: Additional benefits like profit-sharing or commissions.

Social Contributions and Deductions

Social contributions in France form a major part of your payslip and fund essential public services, such as healthcare, pensions, and unemployment insurance. These include:

- CSG (Contribution Sociale Généralisée) and CRDS (Contribution au Remboursement de la Dette Sociale): Contributions for healthcare and national debt repayment.

- Pension Contributions: Payments toward public and supplementary pension schemes.

- Unemployment Insurance (Assurance Chômage): Ensures financial support in case of job loss.

- Health Insurance (Assurance Maladie): Covers medical care costs.

- Family Contributions: Funds family allowances and childcare support.

Key Takeaway: These deductions can amount to 20-23% of your gross salary, but they ensure access to robust public services.

Employer Contributions

Your employer also pays contributions, typically 30-40% of your gross salary, covering:

- Pension schemes.

- Health insurance.

- Professional training funds.

While these do not directly impact your net pay, they represent the cost of employing you and contribute to France’s generous social system.

Taxable Income

After deducting social contributions, the taxable income is calculated. This is the amount on which your income tax is based. France uses a progressive tax system, and your taxable income is key to determining your tax bracket.

Net Pay Before Tax

This is your take-home pay before income tax is deducted. It includes:

- Your gross salary.

- Minus all social contributions.

For many employees, this is the figure you’ll see deposited in your bank account if income tax is paid separately.

Net Pay After Tax

If your employer uses the PAS (Prélèvement à la Source) system, your income tax is automatically deducted from your payslip. The net pay after tax is the final amount you receive.

Other Important Information

Payslips may also include:

- Transport Allowance: Reimbursements for commuting costs.

- Meal Vouchers: Contributions to meal tickets (tickets-restaurant).

- Profit-Sharing (Participation/Intéressement): Bonus linked to company performance.

Why It’s Important to Review Payslip

- Ensure Accuracy: Verify all deductions and payments are correct to avoid underpayments or overpayments.

- Identify Errors: Common mistakes include incorrect tax codes or missed contributions.

- Understand Your Rights: Your payslip provides proof of earnings and contributions, which is essential for benefits like pensions or unemployment support.

Leave Balances

Most French payslips include a section detailing your paid leave balance:

- CP (Congés Payés): Paid vacation days accrued.

- RTT (Réduction du Temps de Travail): Additional days off for those on a 35-hour workweek.

Helpful Tool

f you need more clarity, you can use simulators to calculate your gross-to-net pay:

By regularly reviewing your payslip, you can ensure that your finances are accurate and take control of your earnings in the French system.

UK Net Pay vs. France Net Pay: A Detailed Comparison

When comparing net take-home between the UK and France, it’s important to consider not only the take-home salary but also the deductions, benefits, and social services each country provides. Both countries have unique tax systems, contribution rates, and public services that significantly affect how gross salary translates into take-home pay. Here’s a detailed comparison to help you understand the differences.

Income Tax Structure

UK: The UK has a progressive income tax system, with tax bands applied to taxable income. For the 2024/25 tax year:

- 0% (Personal Allowance): Up to £12,570.

- 20% (Basic Rate): £12,571 to £50,270.

- 40% (Higher Rate): £50,271 to £125,140.

- 45% (Additional Rate): Above £125,140.

Tax is deducted at the source via the PAYE (Pay As You Earn) system, and adjustments are made annually based on earnings and allowances.

France: France also uses a progressive tax system with slightly higher rates:

- 0%: Up to €11,294.

- 11%: €11,295 to €28,797.

- 30%: €28,798 to €82,341.

- 41%: €82,342 to €177,106.

- 45%: Above €177,106.

In France, income tax is deducted at the source using Prélèvement à la Source (PAS), a similar system to PAYE.

Key Difference: The UK offers a higher tax-free personal allowance, meaning low and middle-income earners may keep more of their gross salary. However, higher-income earners in France face lower maximum tax rates compared to the UK's 45% top rate.

Social Contributions

UK: In the UK, National Insurance (NI) is the primary social contribution:

- Employees pay 12% on earnings between £12,570 and £50,270, and 2% above £50,270.

- Employers pay an additional 13.8% on employee earnings above £9,100.

NI contributions fund healthcare (NHS), state pensions, and other benefits. These contributions are lower compared to France.

France: Social contributions in France are significantly higher but fund extensive public services:

- Employees contribute 20-23% of their gross salary for healthcare, pensions, unemployment insurance, and family benefits.

- Employers contribute 30-40% of the gross salary for similar programs.

Key Difference: While French employees see higher deductions for social contributions, they receive access to universal healthcare, generous pensions, and robust unemployment benefits. In contrast, the UK's NI system provides fewer benefits but results in higher net pay.

Healthcare and Benefits

UK:

- Healthcare is provided through the NHS, funded by National Insurance and general taxation.

- Public healthcare is free at the point of use but often has long waiting times. Private healthcare is available at an additional cost.

France:

- Healthcare in France is universal, with most medical costs reimbursed by Assurance Maladie (public health insurance).

- Patients typically pay upfront and receive reimbursements of 70-100% of costs, depending on the treatment. Employers often provide complementary insurance to cover remaining costs.

Key Difference: France's healthcare system offers broader access and higher reimbursements, but upfront costs can be a burden for some. The UK’s NHS is free at the point of use but often comes with limitations in availability.

Paid Leave and Work Benefits

UK:

- Minimum paid leave: 28 days annually, including public holidays.

- Maternity leave: Up to 39 weeks, with pay for the first 6 weeks at 90% of earnings, and a flat rate thereafter.

- Sick leave: Statutory Sick Pay (SSP) offers £109.40 per week for up to 28 weeks.

France:

- Minimum paid leave: 30 days annually, excluding public holidays.

- Maternity leave: 16 weeks fully paid for the first child, longer for subsequent children or complicated pregnancies.

- Sick leave: Employees receive 50-90% of their gross salary, depending on the duration and employer policies.

Key Difference: France offers more generous leave entitlements, particularly for maternity and sick leave, while the UK provides fewer statutory benefits but greater flexibility for employers.

Cost of Living and Tax Impact

- UK: Higher housing costs, particularly in cities like London, can reduce disposable income. However, lower taxes and social contributions result in a higher net pay percentage of gross salary.

- France: Housing costs outside Paris are generally lower, but higher social contributions and income taxes reduce net pay. These deductions fund public services, meaning you get more benefits in return.

Which System is Better for You?

- If you prioritise higher net pay: The UK system allows you to keep more of your gross salary but with fewer government-funded benefits.

- If you value social services and work-life balance: France offers extensive public services, paid leave, and healthcare, though at the cost of higher deductions.

Frequently Asked Questions:

Can I calculate my net pay online?

Yes, many tools and calculators in France, such as official government platforms, allow you to estimate your salary by entering your gross salary and personal details.

What is net pay, and how is it calculated in France?

Your pay is the amount you take home after deductions like income tax, social contributions, and pension contributions. It reflects your actual earnings that can be spent or saved.

Why does my net pay differ from my gross salary?

The difference comes from mandatory deductions, such as income tax (based on tax brackets), healthcare contributions, unemployment insurance, and retirement funds. These are essential for accessing France's robust social security system.

How does my tax bracket impact my net pay?

Your gross salary determines your tax bracket, which influences how much income tax you owe. Higher brackets mean more deductions, reducing your salary pay proportionally.

Can I increase my net pay?

Yes, through strategies like opting for specific tax benefits, contributing to employer-matched savings plans, or negotiating salary increases that account for deductions.

What social contributions are included in my deductions?

Social contributions cover health insurance, pensions, unemployment, and family benefits. These deductions ensure access to France's comprehensive social security system.

How does the French income tax reform impact my net pay?

The 2024 tax reform adjusts brackets for inflation, ensuring that salary increases don't push you into higher tax brackets unnecessarily. This helps stabilise your net income.

Why does my net pay vary from month to month?

Monthly variations may occur due to bonuses, overtime, or changes in taxable benefits. Annual adjustments in tax rates or contributions can also cause fluctuations.

What happens to my net pay if I move to a different region in France?

While income tax rates are uniform nationwide, local taxes, such as residence tax, can vary by region and may indirectly affect your disposable income.

How do family circumstances affect my net pay?

France’s tax system offers allowances for dependents or joint filing for married couples, which can reduce your taxable income and increase your net pay.

Helpful resources:

Personalised net pay calculation in France, including adjustments for your circumstances, use the France Salary Simulator.

For a global salary calculator that compares net pay across multiple countries, explore the tool available at the link below.