Income Tax Calculation

Income tax is calculated based on the UK progressive tax bands:

Personal Allowance: Income up to £12,570 is tax-free.

Basic Rate (20%): Income between £12,571 and £50,270 is taxed at 20%.

Higher Rate (40%): Income between £50,271 and £125,140 is taxed at 40%.

Additional Rate (45%): Income over £125,140 is taxed at 45%.

Personal Allowance decreases for incomes over £100,000 by £1 for every £2 above this threshold, reducing to £0 at £125,140.

National Insurance (NI) Calculation

National Insurance contributions are calculated based on earnings and vary by class:

Class 1 NI Contributions:

Primary Threshold: Earnings up to £12,570 are NI-free.

Main Rate (12%): Earnings between £12,571 and £50,270 are charged at 12%.

Upper Earnings Limit (2%): Earnings over £50,270 are charged at 2%.

Pension Contributions

Pension contributions are calculated as a percentage of your salary.

The minimum workplace pension contribution under auto-enrollment rules:

Employee Contribution: 5% of qualifying earnings.

Employer Contribution: 3% of qualifying earnings.

Qualifying Earnings: Earnings between £6,240 and £50,270 (2023/24 thresholds).

For example:

If your annual salary is £30,000:

Qualifying earnings = £30,000 - £6,240 = £23,760.

Employee contribution = 5% of £23,760 = £1,188 annually.

Employer contribution = 3% of £23,760 = £713 annually.

Student Loan Repayments

Student loan repayments depend on your repayment plan type and income:

Plan 1: For students who started university before 1 September 2012.Repayment threshold: £22,015.

Repay 9% of income above this threshold.

Plan 2: For students who started university after 1 September 2012.

Repayment threshold: £27,295.

Repay 9% of income above this threshold.

Plan 4: For students from Scotland who started university before 2006 or borrowed under the Scottish system.

Repayment threshold: £27,660.

Repay 9% of income above this threshold.

Plan 5 (Postgraduate Loan):

For postgraduate loans, the repayment threshold is £21,000.

Repay 6% of income above this threshold.

Example:

If you earn £30,000 under Plan 2:

Income above the threshold = £30,000 - £27,295 = £2,705.

Repayment = 9% of £2,705 = £243.45 annually.

Key Changes in Net Pay Calculations for 2025

Net Pay UK: A Detailed Guide to Take-Home Pay 2024/2025

The 2024/25 NHS Pay Rise introduces a 5.5% increase across all NHS bands in England, Northern Ireland, and Wales. This adjustment is retroactive to April 1, 2024, with back pay included, marking a significant boost for many staff members.

Additionally, for those in Bands 8 and 9, the progression up the pay scale has been streamlined from 5 years to just 2, now featuring 3 pay steps for these roles.

To simplify understanding, I’ve created a breakdown of annual and monthly net salaries post-increase. This guide accounts for the new pension contributions, the lower 8% National Insurance rate, and the updated 2024/25 tax brackets, providing a comprehensive view of your take-home pay.

NHS Net Pay 2024/25

| Band | Gross Salary | Monthly Net |

| B2 (Step 1) | £23,614 | £1,606 |

| B3 (Step 1) | £24,071 | £1,632 |

| B3 (Step 2) | £25,674 | £1,710 |

| B4 (Step 1) | £26,530 | £1,768 |

| B4 (Step 2) | £29,114 | £1,879 |

| B5 (Step 1) | £29,969 | £1,926 |

| B5 (Step 2) | £32,324 | £2,054 |

| B5 (Step 3) | £36,483 | £2,235 |

| B6 (Step 1) | £37,339 | £2,280 |

| B6 (Step 2) | £39,404 | £2,390 |

| B6 (Step 3) | £44,962 | £2,686 |

| B7 (Step 1) | £46,148 | £2,749 |

| B7 (Step 2) | £48,526 | £2,895 |

| B7 (Step 3) | £52,809 | £3,098 |

| B8A (Step 1) | £53,754 | £3,153 |

| B8A (Step 2) | £56,454 | £3,304 |

| B8A (Step 3) | £60,503 | £3,480 |

| B8B (Step 1) | £62,215 | £3,480 |

| B8B (Step 2) | £66,247 | £3,628 |

| B8B (Step 3) | £72,294 | £3,922 |

| B8C (Step 1) | £74,290 | £4,006 |

| B8C (Step 2) | £78,814 | £4,197 |

| B8C (Step 3) | £85,601 | £4,482 |

| B9 (Step 1) | £105,385 | £5,315 |

| B9 (Step 2) | £111,739 | £5,619 |

| B9 (Step 3) | £121,271 | £6,024 |

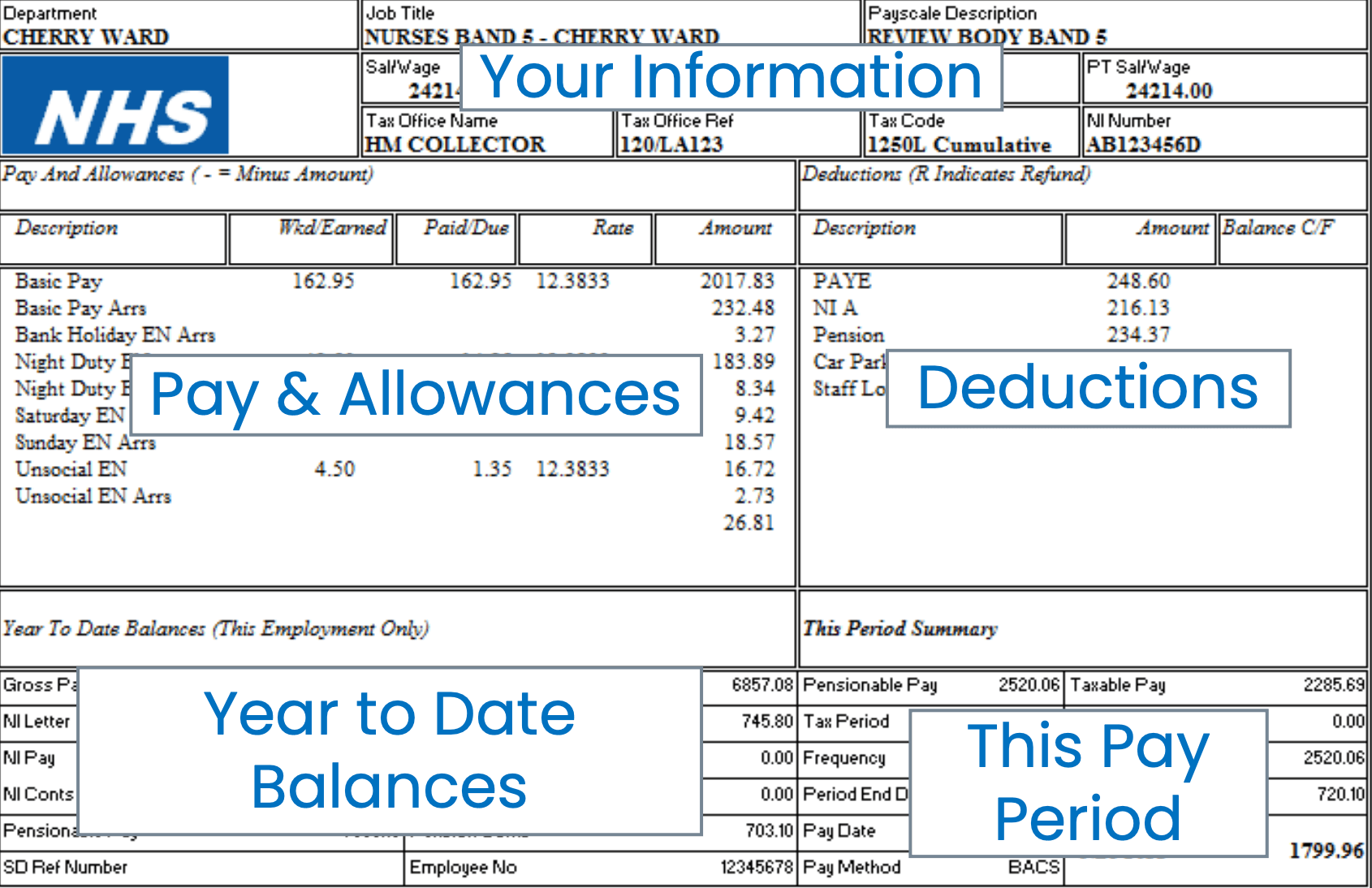

Payslip

Your payslip clearly shows your net pay in the UK, the amount you take home after deductions. It shows exactly how much of your gross salary stays in your pocket after covering tax, NI, and pension. Look for it under “Net Pay” or “Take Home Pay” to understand where your hard-earned money is going.

With over 10 years of experience in the NHS, I’ve learned how crucial it is to stay vigilant about reviewing your payslip. In large organisations like the NHS, where payroll manages thousands of employees, mistakes often occur.

For example, being overpaid might seem like an unexpected bonus at first. However, it quickly turns into a stressful situation when credit control demands repayment. To prevent such issues, I always take the time to check my payslip regularly. This habit allows me to identify errors, such as incorrect tax codes, missed pension contributions, or unexpected deductions, before they escalate into bigger problems.

By taking control of your payslip, you can ensure your finances remain accurate and avoid unnecessary stress. Remember, it’s your hard-earned money, and you have every right to protect it!

Want to learn more? Explore the importance of checking your payslip and discover how to spot and resolve common errors.

UK Net Pay vs. USA Net Pay: A Detailed Comparison

When comparing net pay in the UK and the USA, there are notable differences in taxation systems, deductions, and the average take-home salary.

Here’s a breakdown of the key factors:

Key Differences in Deductions UK vs. USA

Healthcare Costs:

- The NHS (National Health Service) in the UK is funded through general taxation and NI contributions. There are no direct healthcare deductions beyond NI.

- In the USA, healthcare is primarily privatised. Many employees pay for health insurance through employer-provided plans, which can cost $5,000–$10,000 annually, reducing net pay.

Pensions/Retirement Contributions:

- UK employees are automatically enrolled in workplace pension schemes, with mandatory minimum contributions (currently 5% from employees and 3% from employers).

- In the USA, contributions to 401(k) retirement plans are optional, with employer matching available in some cases. Contributions are pre-tax but can vary widely.

Child and Dependent Care:

- The UK provides tax relief for childcare costs through government schemes, reducing the financial burden.

- In the USA, dependent care deductions are limited and depend on specific tax credits.

Taxation Systems: UK vs. USA

United Kingdom:

- The UK operates a progressive income tax system with tax bands ranging from 20% (basic rate) to 45% (additional rate) based on income.

Additionally, employees contribute to National Insurance (NI), which funds public services like healthcare and pensions. NI rates are 12% on earnings above £12,570, with reduced rates for higher incomes.

United States:

- The USA also uses a progressive tax system, with federal income tax brackets ranging from 10% to 37% in 2024.

State income taxes vary significantly (e.g., California's top rate is 13.3%, while states like Texas and Florida impose no state income tax).

Social Security and Medicare taxes (FICA) are mandatory, totalling 7.65% of gross pay for employees.

Average Take-Home Pay UK vs. USA

United Kingdom:

- The average annual gross salary is approximately £33,000, with a net take-home pay of around £25,000 after taxes and NI contributions.

- The cost of living in the UK is generally lower in smaller towns but higher in cities like London.

United States:

- The average annual gross salary is approximately $60,000

- The cost of living varies drastically, with cities like New York or San Francisco being significantly more expensive than rural areas.

Where Is It More Beneficial to Be Employed?

Net Pay Advantage:

- The USA generally offers higher gross and net salaries, particularly in high-paying industries like tech, finance, or healthcare.

However, higher healthcare and retirement costs often offset this advantage.

Social Benefits:

- The UK provides universal healthcare (NHS) and more robust social welfare systems, offering greater security for families and individuals.

- In the USA, employees need to factor in substantial out-of-pocket healthcare and retirement costs, making net pay potentially less impactful despite higher figures.

Flexibility and Tax Deductions:

- The USA allows for more flexibility in tax deductions (e.g., 401(k), HSAs, and state-specific tax rates).

- The UK offers simplicity and predictability, with fewer variables in tax and deduction calculations.

Conclusion

If maximising net pay is your primary goal, the USA may be more attractive, especially in high-paying industries and states with no income tax.

However, if you're seeking a more comprehensive benefits system with lower healthcare and retirement costs, the UK offers greater security despite lower gross and net pay figures. The choice ultimately depends on your priorities, such as financial gain versus long-term social safety nets.

Personal Experience UK Stability vs. USA Flexibility

Based on my personal experience living in the UK for 18 years and knowing friends who have worked in both the UK and the USA, here are key observations:

Why the USA is Attractive for Business and Risk-Takers?

Flexible Employment Laws:

- In the USA, it’s easier for businesses to hire skilled workers and adjust their workforce as needed.

Employers can shift skills and roles based on immediate business needs, making it highly dynamic.

Earning Potential:

- The USA offers the chance to earn significantly more, especially in industries like tech, finance, and healthcare.

- High demand for skills creates opportunities for career growth and increased pay.

Risk and Reward:

- The USA is a great option for risk-takers those willing to navigate a competitive system can reap substantial financial rewards.

Why the UK Offers Stability and Security:

Personal Experience with Stability:

- I’ve worked in a civil service organization in the UK for six years.

- Once on a substantive contract, my job felt secure, with consistent pay and deductions.

Static but Predictable Income:

- In the UK, taxes and deductions remain consistent unless there are government reforms.

- Income might not grow as rapidly, but it’s predictable, which is ideal for long-term planning.

Frequently Asked Questions:

What is net pay, and how do I calculate it?

Net pay is what you take home after deductions like tax, National Insurance, pensions, and student loans. It’s easy to feel overwhelmed figuring this out on your own that’s where a net pay my salary calculator helps. You pop in your gross salary, and it works out the math, showing exactly what will land in your account.

Why doesn’t my net pay match what I expected?

Your net pay can change for many reasons new tax codes, pension adjustments, or even updated student loan thresholds. From my years working in the NHS, I’ve seen overpayments or underpayments happen due to payroll errors. That’s why I always cross-check my payslip with a net pay salary calculator. It quickly shows any discrepancies, whether it’s a missed deduction or changes to taxable income.

What’s the difference between gross salary and net pay?

Your gross salary is the total amount you earn before any deductions. Think of it as your salary “on paper.” Net pay, on the other hand, is what’s left after all the deductions this is the money that hits your bank account. To make it easier, I like to use my salary calculator to break it all down. It’s a quick way to see how things like pensions or NI rates impact what you take home.

Why is it important to check my payslip regularly?

Mistakes happen, especially in big organisations like the NHS. Overpayments, underpayments, or incorrect deductions are more common than you’d think. I’ve seen colleagues deal with the stress of credit control chasing them to repay overpaid amounts. Regularly checking your payslip helps you catch errors early. Using a net pay calculator alongside your payslip makes it even easier to spot problems before they turn into bigger headaches.

How does a pension contribution affect my net pay?

Pension contributions lower your taxable income, so you pay less tax but they also reduce your net pay since they come out of your gross salary. I get that pensions can be confusing, especially with changing rates, but they’re worth it for your future. A net pay UK calculator with the latest pension rates shows exactly how your take-home pay is affected, helping you stay in control of your finances.

These FAQs are designed to give you a clear understanding of your net pay, and using tools like net pay calculators will make managing your finances easier and less stressful! Let me know if you want more details or additional questions covered.

If you’d like to compare salaries in other countries, here are some helpful resources:

US Net Pay Calculator: Allows you to calculate net pay based on the specific state, providing insight into state tax systems.

France Net Pay Calculator: This helps you understand how the French tax system works by calculating net pay in France.

Global Net Pay Calculator: compare take-home pay across countries, understand deductions, and plan smarter for your next career move.